While most states use a marginal bracketed income tax system similar to the federal income tax every state has a completely unique income tax code. Alaska Florida Nevada South Dakota Texas Washington and Wyoming.

States With The Highest And Lowest Sales Taxes

States With The Highest And Lowest Sales Taxes

Forty-three states impose state income taxes.

State taxes by state. 1 to 1330 the highest rate applying to incomes over 1000000. But residents of these states pay no income tax. 336 50000 424 50000.

2 to 59 the highest rate applying to incomes over 8000. 51 rows New York also has the highest individual income tax rate of 440. Tax Day 2021.

2 to 5 the highest rate applying to incomes over 3000 7. Tax per 1000. For example seven states dont have income taxes.

In the remaining states total state and average local tax rates range from 534 to 955. Sales and excise taxes. States Without Property Taxes.

259 to 8 the highest rate applying to incomes over 250000. Hawaii has a general excise tax thats very similar to a sales tax though at 400 it would be one of the lowest sales taxes in the US. State and Local Taxes.

Alaska Delaware Montana New Hampshire and Oregon are free of sales tax but some Alaska cities charge local sales tax. Tennessee has the highest sales tax rates in the US. Total Tax Burden Property Tax Burden Individual Income Tax Burden Total Sales Excise Tax Burden 1.

200 0 400 500. 400 1000 500 3000. In Alabama the per capita amount paid is only 582 while in Oklahoma and Arkansas its 731 and 741 respectively.

States with the highest sales tax rates are California Indiana Mississippi Rhode Island and Tennessee. Alabama Oklahoma and Arkansas have the lowest property tax per capita. These states dont require you to file a tax return.

Connecticut is the only other state whose per capita property tax by state is over 3000 3020. Most states have a progressive tax system. 440 6 496 1 343 22 2.

51 rows State Alcohol Tax by State. Alaska has no state sales tax but does have some local sales taxes. 460 4 245 21 345 20 5.

The more you earn the more you pay in state income taxes. Tax per 1000. Each year businesses pay more in payroll taxes than income taxes.

Federal taxes are due on May 17 -- and most state taxes are due then too. Forty-five states and the District of Columbia impose a state sales and use tax. Of the nine states that dont impose state income tax on wages Tennessee and New Hampshire they do collect tax on dividends and interest.

Taxpayers must pay personal income tax to the federal government 43 states and many local municipalities. To learn how they affect your business click on a state to get a comprehensive overview of the key payroll regulations including a detailed breakdown of your responsibilities for federal state and local payroll taxes. Most state governments in the United States collect a state income tax on all income earned within the state which is different from and must be filed separately from the federal income tax.

Choose any state from the list above for detailed state income tax information including 2021 income tax tables state tax deductions and state. For example the fact that Washington State has no income tax doesnt necessarily mean it has lower taxes overall than Oregon which has income tax but no sales tax. 259 0 288 10000.

State and Local Sales Taxes. 504 2 241 22 330 26 4. 500 6000 Alaska.

To determine which states have the highest and lowest taxes you have to look at all of the taxes each state charges. Hawaii follows with a. Tax per 1000.

Alaska Delaware Montana New Hampshire and Oregon. 211 rows State individual income tax rates brackets 2016 State Single filer rates Brackets Married filing jointly rates Brackets Ala. Get State-By-State Payroll Tax Information.

Learn how to pay your state taxes and find out about resources in your area that can help you through the process. 406 7 356 6 282 39 6. 288 20000 336 25000.

245 35 309 10 665 1 3. And five have no state sales taxes.

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

State Income Tax Reliance Individual Income Taxes Tax Foundation

State Income Tax Reliance Individual Income Taxes Tax Foundation

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

State Tax Revenue Makes Biggest Gains In Seven Years The Pew Charitable Trusts

State Tax Revenue Makes Biggest Gains In Seven Years The Pew Charitable Trusts

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation

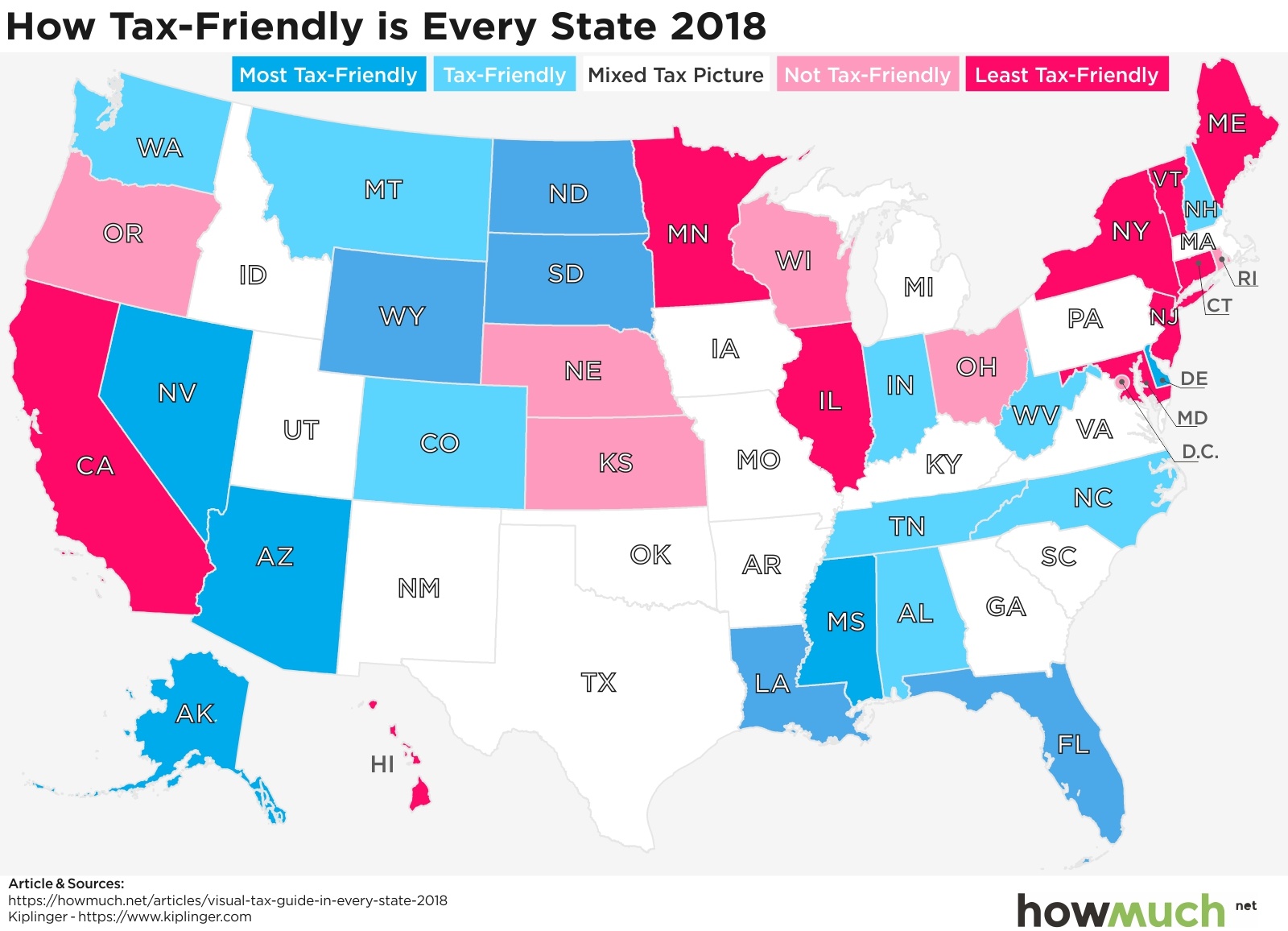

State By State Guide To Taxes On Middle Class Families

State By State Guide To Taxes On Middle Class Families

State Tax Maps Cigar Association Of America Inc

State Tax Maps Cigar Association Of America Inc

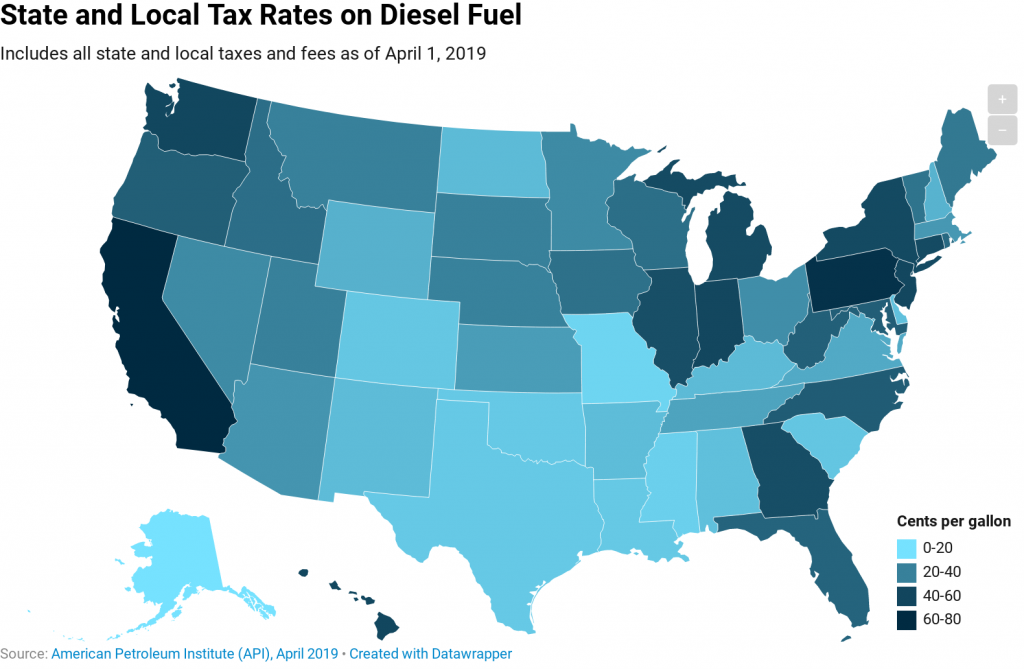

What Is The Diesel Fuel Tax Rate In Your State Itep

What Is The Diesel Fuel Tax Rate In Your State Itep

How Much Does Your State Collect In Property Taxes Per Capita

How Much Does Your State Collect In Property Taxes Per Capita

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.