An insurance company or a government and an individual or hisher sponsor that is an employer or a community organization. Glossary of Commercial Insurance Terms Commercial insurance is divided into two main categories.

Perspectives In Commercial Health Insurance Leveraging Information A

Perspectives In Commercial Health Insurance Leveraging Information A

When evaluating any type of commercial health insurance it is important to make sure the plan will provide adequate coverage.

Commercial health insurance definition. The commercial insurance definition is simply insurance you buy that is designed to protect you from unforeseen circumstances that can affect your business. O Commercial health insurance is any type of health care coverage not obtained from Medicare or ForwardHealth programs eg Wisconsin Medicaid or BadgerCare Plus. It may be provided on a fee-for-service basis or through a managed care plan.

Commercial health insurance even with regulations has an entirely different mandate. Its fundamental purpose is commercial. Indemnity plan - A type of medical plan that reimburses the patient andor provideras expenses are incurred.

Often people enroll through an employer who either covers the entire premium or a portion of it with the remaining cost deducted from the participating employees payroll. Also known as private-funded insurance these plans primarily are provided through benefits plans provided by employers. Commercial health insurance is any type of health insurance that is not offered and managed by a government entity.

You may receive commercial insurance through your employer or your spouses employer or as part of your. Commercial Property Inland Marine Boiler. Is a discrete package of health insurance coverage benefits that are offered using a particular product network type such as health maintenance organization preferred provider organization exclusive provider organization point of service or indemnity within a service area.

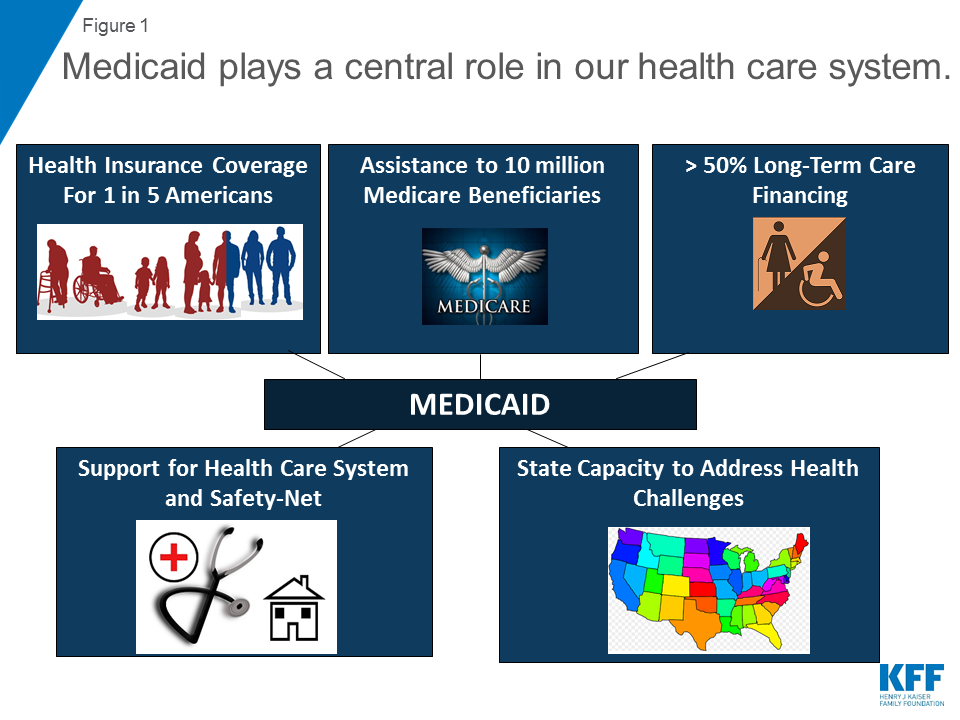

The term property insurance includes many lines of available insurance. Medicaid is funded by the federal and state governments and managed by the states. Types of Commercial Health Insurance.

It can cover medical expenses and disability income for the insured. Commercial health insurance - a Private insurance. These plans reimburse the patient andor provider as expenses are incurred.

Its fundamental purpose is commercial. For the most part commercial health insurance is defined as a health insurance plan not administered by the government. Conventional indemnity plan - An indemnity that allows the participant the choice of any provider without effect on reimbursement.

The contract can be renewable annually monthly or lifelong in the case of private insurance. Commercial health insurance is any type of healthcare policy that is not administered through a government program. It may be employer-sponsored or privately purchased.

187 were donated in February This month we are on track to donate 189 home recent additions webmaster page banners feed a child. Coverage may include business property damage loss of income due to a business interruption legal issues theft and employees grievances. Providers are for-profit and offer both group and individual plans.

Property insurance and casualty insurance. Employer-provided group health insurance policies are commercial as are individual policies people can buy if they do not receive employer or government insurance benefits. Medicare Advantage which is a government plan is administered by private insurance companies approved by Medicare.

If you are using your vehicle in a commercial venture or for hire you must have commercial insurance. A health insurance policy is. Commercial health insurance is any type of health insurance policy not offered or provided by the government.

If your healthcare policy is not part of one of the aforementioned government programs it is a commercial health insurance policy. A contract between an insurance provider eg. Property insurance provides coverage for property that is stolen damaged or destroyed by a covered peril.

Commercial health insurance is health insurance provided and administered by non-governmental entities. Commercial insurance refers to a policy that is meant to protect a business from future risks. Commercial insurances mandate.

There is no practical difference between commercial and private insurance policies they both protect you financially from liability in the case of an accident. Medicaida health insurance program created in 1965 that provides health benefits to low-income individuals who cannot afford Medicare or other commercial plans. In the case of a.

Medical Billing Vocabulary Key Terms

Medical Billing Vocabulary Key Terms

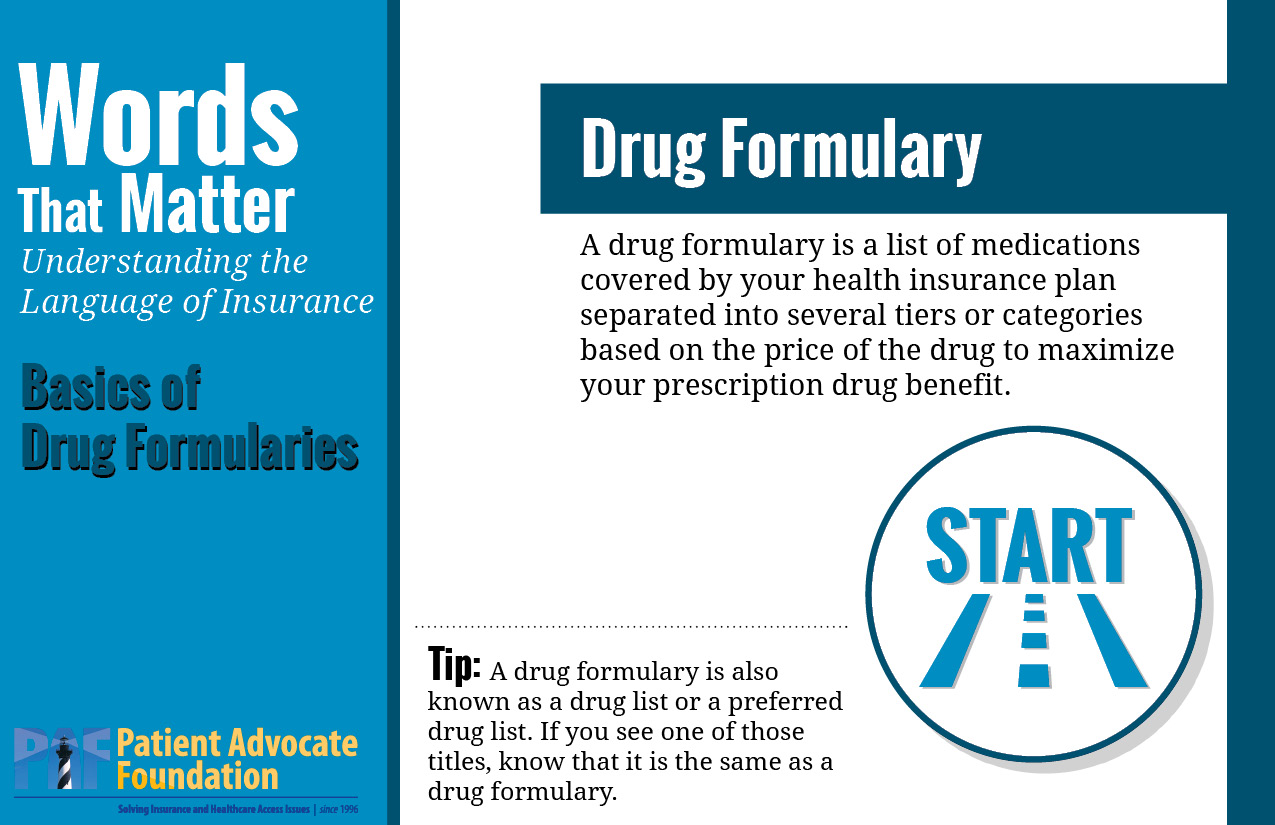

The Language Of Insurance Patient Advocate Foundation

The Language Of Insurance Patient Advocate Foundation

Workers Compensation Vs Health Insurance The Hartford

Workers Compensation Vs Health Insurance The Hartford

Health Insurance Commercial General Liability Insurance Word Png Clipart Blue Brand Business Cloud Definition Free Png

Health Insurance Commercial General Liability Insurance Word Png Clipart Blue Brand Business Cloud Definition Free Png

Is Insurance Policy Definition Still Relevant Insurance Policy Definition Https Ift Tt 33qsbzr Insurance Accident Insurance Life Insurance Policy

Is Insurance Policy Definition Still Relevant Insurance Policy Definition Https Ift Tt 33qsbzr Insurance Accident Insurance Life Insurance Policy

The Language Of Insurance Patient Advocate Foundation

The Language Of Insurance Patient Advocate Foundation

:max_bytes(150000):strip_icc()/health-insurance-2b0b341bec334ad68e5c019983dd709a.jpg) Commercial Health Insurance Definition

Commercial Health Insurance Definition

Health Insurance Coverage In The United States Wikipedia

Health Insurance Coverage In The United States Wikipedia

Perspectives In Commercial Health Insurance Leveraging Information A

Perspectives In Commercial Health Insurance Leveraging Information A

Different Types Of Health Insurance Plans

Different Types Of Health Insurance Plans

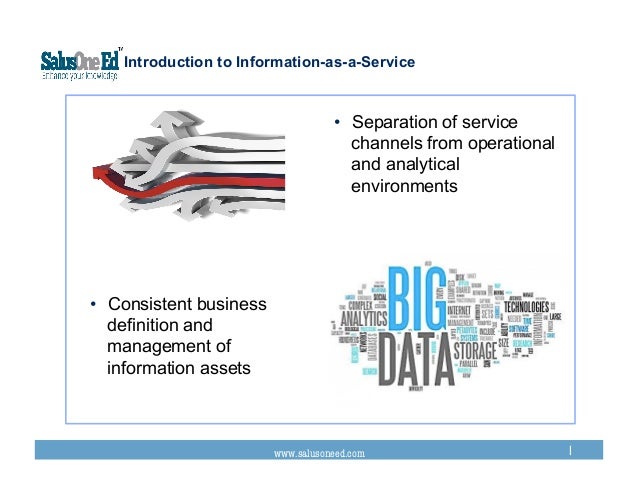

Perspectives In Commercial Health Insurance Leveraging Information A

Perspectives In Commercial Health Insurance Leveraging Information A

Comparing Epsdt And Commercial Insurance Benefits Commonwealth Fund

Comparing Epsdt And Commercial Insurance Benefits Commonwealth Fund

10 Things To Know About Medicaid Setting The Facts Straight Kff

10 Things To Know About Medicaid Setting The Facts Straight Kff

/man-at-the-table-fills-in-the-form-of-health-insurance--healthcare-concept--vector-illustration-flat-design-style--682211990-bcd44344bfb04adc91f0d35376838b10.jpg) Commercial Health Insurance Definition

Commercial Health Insurance Definition

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.